In the fast-paced world of currency trading, having the right tools can make all the difference. Forex trading software is designed to provide traders with the necessary resources to analyze markets, execute trades, and manage their investments effectively. Whether you are a beginner or an experienced trader, utilizing robust software can amplify your trading performance. To explore more about trading and tools available, visit forex trading software https://exbroker-argentina.com/.

Understanding Forex Trading Software

Forex trading software encompasses various technological solutions that assist traders in navigating the foreign exchange market. These tools provide real-time data, analytical capabilities, and the ability to execute trades efficiently. There are different types of software catering to different trading styles, from manual trading platforms to automated solutions powered by algorithms.

Types of Forex Trading Software

1. Trading Platforms

Trading platforms are the most common type of forex software used by traders. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer robust features, including charting tools, technical indicators, and customizable interfaces. They provide traders with everything they need to execute their trades while offering a user-friendly experience.

2. Automated Trading Systems

Automated trading systems, also known as trading robots or Expert Advisors (EAs), are designed to implement trades on behalf of the trader. These systems use algorithms based on predefined trading strategies to automatically execute buy and sell orders when certain market conditions are met. They can be advantageous for traders who want to remove emotions from their trading decisions or who wish to trade continuously without the need for hands-on management.

3. Charting Software

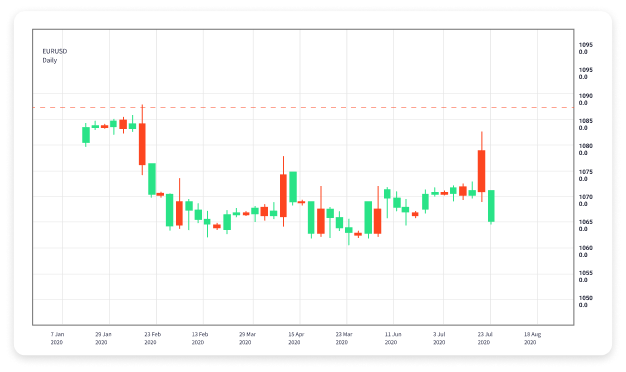

Charting software allows traders to visualize price movements and patterns in the forex market. This software typically offers tools for technical analysis, including trend lines, pivot points, and various chart types. By providing a graphical representation of currency pair performance, traders can better identify potential entry and exit points.

4. Forex Signal Services

Forex signal services provide traders with trading signals based on analytical insights. These signals can indicate when to buy or sell specific currency pairs, helping traders to make informed decisions. Some traders prefer to follow signals provided by professional traders or institutions, while others may use signals generated by software based on technical indicators.

Benefits of Using Forex Trading Software

1. Efficiency and Speed

One of the most significant advantages of using forex trading software is the speed of execution. Automated systems can handle trades far more quickly than manual trading, which means greater opportunities to capitalize on market movements and volatility. This can be particularly beneficial in the forex market, where prices can change rapidly.

2. Improved Accuracy

Forex trading software helps reduce human error, which is often a significant factor in trading losses. By relying on algorithms and data-driven strategies, traders can achieve more consistent results. This increased accuracy can lead to improved profit margins over time.

3. Enhanced Data Analysis

With the vast amount of data available in the forex market, analyzing market trends can be overwhelming. Forex trading software incorporates advanced analytical tools to help traders make sense of this data. By identifying trends and patterns, traders can develop strategies based on factual market behavior rather than speculation.

4. Customization

Many trading platforms offer customization options, enabling traders to design their workspaces according to their preferences. This flexibility allows traders to focus on the technical indicators and resources that are most relevant to their trading style, promoting a more personalized trading experience.

Choosing the Right Forex Trading Software

When selecting forex trading software, it is essential to consider several factors to ensure it meets your trading needs:

- User-Friendly Interface: A user-friendly interface can significantly improve your trading experience, especially if you are new to the market.

- Available Features: Identify the features that are most important to you, such as technical analysis tools, automated trading capabilities, or mobile accessibility.

- Security Measures: Ensure the software provider has robust security protocols in place to protect your sensitive information.

- Customer Support: Good customer support can be crucial when dealing with technical issues or inquiries about the software.

Conclusion

In conclusion, forex trading software plays a pivotal role in maximizing trading opportunities and enhancing performance in the foreign exchange market. Whether you opt for a trading platform, automated trading system, or charting software, the right choice can streamline your trading process and improve your decision-making capabilities. By embracing modern technology, traders can unlock their potential and achieve greater success in their forex endeavors.

As you navigate the complex world of forex trading, remember to continuously educate yourself and experiment with different software solutions to find what works best for you. The right tools can not only enhance your skills but also elevate your trading profits significantly.